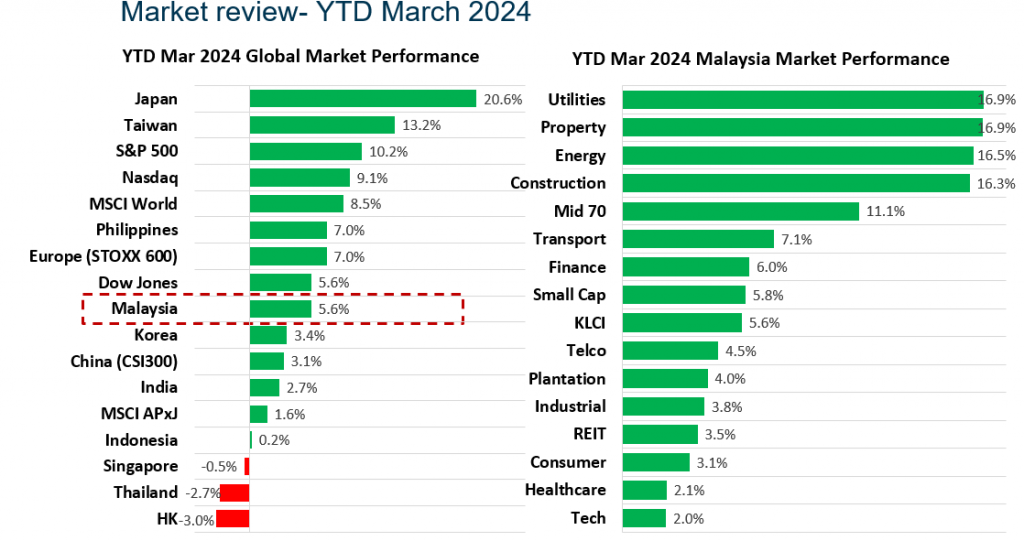

During the first quarter of 2024, resilient economic data propelled global equities, with the MSCI World rising 8.5%. Developed market equities, particularly in the US, Europe and Japan, performed strongly, while emerging market equities underperformed amid concerns over China’s growth. Meanwhile, there remains a positive return for India, albeit at a slower pace. In Malaysia, the market saw a recovery with a +5.6% increase this year, reversing the 2.7% decline experienced in 2023. All sectors showed gains year-to-date as of March 2024, with Utilities, Property, Energy, and Construction leading the way, while Tech and Healthcare sectors lagged behind (see Figure 1).

Figure 1: Global and Malaysia Market Performance YTD March 2024

Source: Bloomberg, PCM

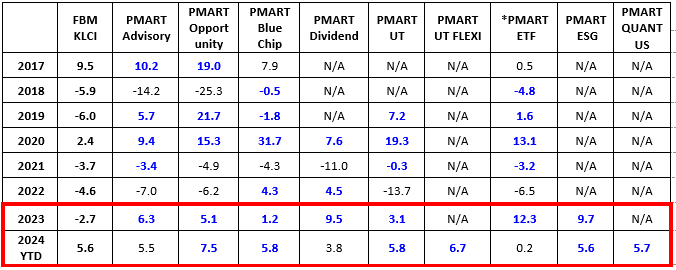

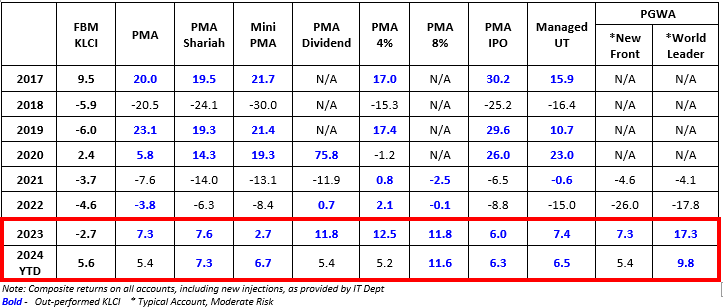

In our previous piece, we highlighted that despite the challenges of 2023, the majority of our Private Managed Accounts achieved positive returns, surpassing the 2.7% decline in the KLCI. As we transitioned into 2024, the first quarter concluded with continued strong performance, driven by our commitment to effective bottom-up stock selection and prudent management practices, enabling us to navigate the market adeptly. Please see Figure 2 for a summary of our performance across different mandates.

Figure 2: PCM Private Managed Accounts Historical Performance

A: Phillip Managed Account for Retirement (PMART)

B: Phillip Managed Account (PMA) & Phillip Global Wrap Account (PGWA)

Source: PCM

2024’s Malaysia Outlook

We maintain a favorable outlook on the Malaysian market for the medium to long term, and we anticipate that the five investment themes outlined in our previous analysis will continue to influence the future outlook of the Malaysian market.

- Theme One: Peaking interest rates bode well with equities; Opportunities for Emerging Markets and Malaysia Market

- Theme Two: Stable domestic political environment; Economic restructuring is set to bolster growth prospects

- Theme Three: Reversal in foreign outflows; Robust buying interests from foreigners provides support for Malaysia market

- Theme Four: Recovery in global tech cycle; Malaysia’s Tech and E&E sectors would benefit

- Theme Five: Strong economic fundamentals – Stronger GDP, moderating inflation, low unemployment and an improved MYR.

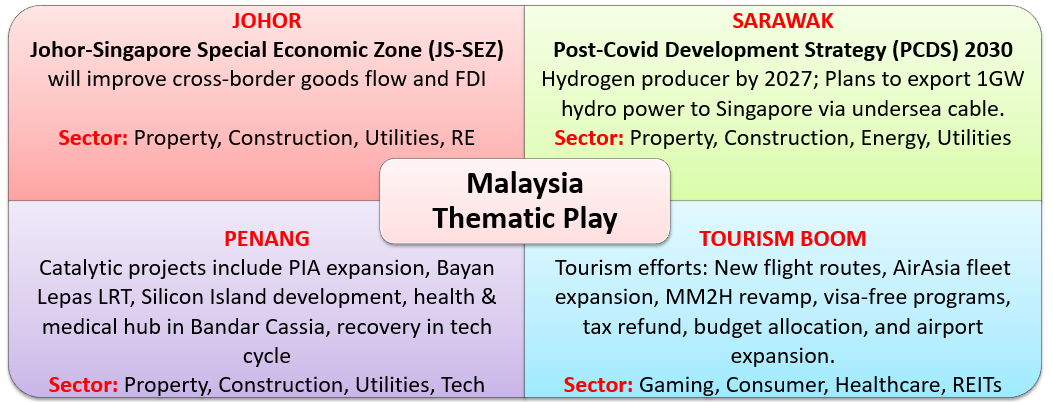

In terms of positioning, we think Johor, Sarawak and Penang thematic play will continue to play out in 2024. The 3 states of Johor, Sarawak and Penang contributed an estimated 26% to Malaysia’s

real GDP in 2022. We see excitement in the 3 states in 2024 driven by catalytic developments and their longer-term growth plans, alongside recovery in tourism which will benefit the country as a whole.

Figure 3: Malaysia Thematic Play

Source: PCM

We will continue to seek for alpha ideas within the large and small to mid-cap space, investing in companies with strong fundamentals, sustainable business models, clear earnings visibility, and a high-quality management team. Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.