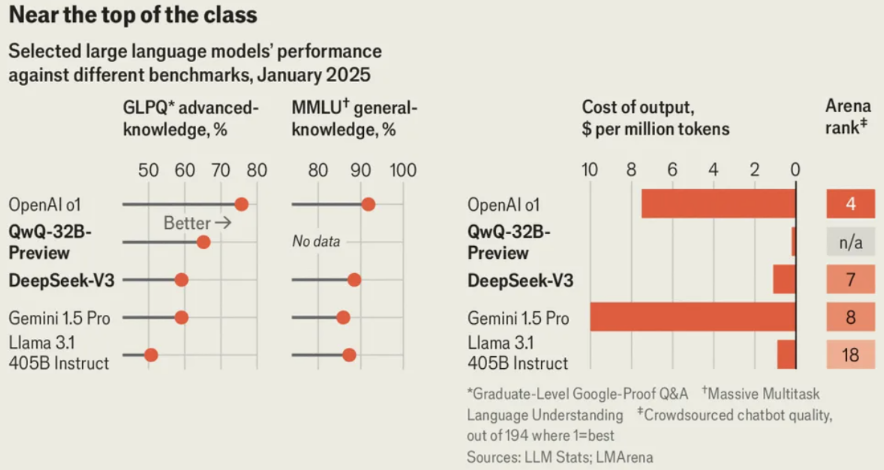

DeepSeek has become a dominant theme in market discussions throughout January, raising concerns about its cost-efficiency, performance capabilities, and use of lower-tier chips. Its rise threatens to undermine U.S. tech dominance, with potential long-term impacts on the global semiconductor industry. If this trend continues, it could shift demand dynamics and reshape market structures, particularly as major tech companies with significant AI investments may need to adjust their strategies.

One key point of contention is DeepSeek’s claim that its V3 model was trained with just under USD6 million, a stark contrast to the USD80-100 million spent by OpenAI on ChatGPT. This discrepancy has raised questions about the true cost and resource allocation in developing such advanced AI models. Additionally, DeepSeek’s use of 2,048 NVIDIA H800 chips—a modified version of the H100—has sparked concerns. These chips are now on the restricted export list, leading to questions about whether DeepSeek is circumventing U.S. sanctions.

While DeepSeek’s models have shown impressive performance, there are concerns about their long-term scalability compared to established U.S.-based AI systems like GPT-4. The sustainability of DeepSeek’s approach and its ability to meet the growing demands of AI applications remain uncertain. DeepSeek’s emergence from China adds geopolitical complexity to the situation, intensifying the ongoing U.S.-China rivalry in AI. The global impact of DeepSeek’s success is already being felt. By offering powerful AI models at a fraction of the cost of U.S. alternatives, it has led to stock declines for major chipmakers like NVIDIA, who rely on high-end chips for AI training. This could shift the focus away from expensive hardware, affecting companies like NVIDIA and ASML.

In Malaysia, the effects are evident in local tech stocks and data-center related stocks. Companies such as YTLPOWR and NATGATE, which are linked to AI and tech infrastructure, have seen declines, reflecting concerns about reduced demand for high-end chips. However, data center contractors like PIE could benefit as the need for data center expansion remains strong. The Malaysian market will be closely watching the responses from major tech players and any regulatory changes that could shape the future of AI and data centers.

Figure 1: Key attributes of DeepSeek

Source: LLM Stats

Our Thoughts

Companies less reliant on high-end chips, especially those in AI infrastructure, data centers, or component manufacturing—such as contractors or mid-tier chip suppliers—are well-positioned to weather current challenges. In Malaysia, firms like GAMUDA, engaged in data center construction, stand to benefit. Tech companies like PIE, which supply essential components, may continue to grow despite changing chip demand. YTLPOWR’s current share price appears to have fully priced in the absence of its data center business. However, concerns over its recent corporate exercise (free non-tradable warrants) remain, and clarity on AI data-center off-take will be key to any potential re-rating.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.