Navigating the Challenges of Scope 3 Emissions

Asia’s strategic role in the global supply chain is underscored by its historical access to cost-effective labour, a robust manufacturing infrastructure, close proximity to major markets in Europe and North America, and supportive government policies, positioning the region as a key player in the worldwide drive towards net zero. In the pursuit of sustainable supply chains, Asia has witnessed significant progress made during the global stocktake at COP28 UAE conducted by the United Nations Climate Change. The need for intensified efforts from businesses to measure and address their carbon emissions is underscored by mounting global regulations, including the IFRS Foundation and International Sustainability Standards Board (ISSB) Standards that came into effect on January 1, 2024.

The Economist reported that Scope 3 emissions, encompassing indirect emissions throughout a company’s value chain, contribute an average of 75% to a company’s total emissions. This figure rises to nearly 99.98% for companies in sectors such as finance, capital goods, transport, and real estate. To recall, we shared the idea of Scopes of Emissions in our previous publication. In summary, Scope 1 emissions are directly controlled or owned by an organisation (think fuel combustion in boilers, furnaces, and vehicles) and Scope 2 emissions are indirectly controlled through the purchase of things like electricity, steam, heat, and cooling. Separately, Scope 3 emissions are indirect emissions that occur in the supply chain of a company but which are not directly produced by the company itself, yet account for a significant portion of overall emissions.

Reducing this third type of emissions can be a challenging task, especially for smaller companies that have limited resources compared to larger listed firms, but despite the complexities it remains an essential part of any net zero plan. To sustain competitiveness, businesses must adopt a comprehensive Scope 3 emissions strategy. Ultimately, the end goal is the decarbonisation of Asia’s supply chains to enhance global competitiveness.

As businesses set ambitious net zero targets, the challenge lies in achieving them, and a potential explanation may be the limited focus on the third scope of emissions within the core of supply chains. Taking Malaysia as example, efforts on reducing the Scope 3 emissions are still at nascent stage with notable efforts from large companies, but limited involvement from SMEs. For now, we observe that Maybank and CIMB took the lead as one of the pioneering banks in Malaysia to establish a Scope 3 financed emissions baseline. Both banks are actively taking measures to align their operations with sustainable practices and contribute to a low-carbon future. For banks, financed emissions are indirect emissions related to loans, underwriting, investments and any other financial services.

Utilities player Tenaga Nasional Berhad is also working towards collecting and analysing the Scope 3 data on Categories 6 (Business Travel) and 7 (Employee Commuting) and remains committed to expand its area of analysis for the rest of the Scope 3 categories across the value chain of its business operation, which includes collaboration with suppliers and vendors to collectively reduce environmental impact and enhance sustainability across the supply chain. Bursa Malaysia has also pledged to be transparent in reporting carbon emissions from its operations and value chain across Scopes 1, 2, and 3 to complement the new climate ambitions set by the government. Sime Darby Plantations, the world’s largest oil palm plantation company by planted area has also pledged to achieve 50% reduction of carbon emissions by 2030. However, these trends are not observed within SMEs yet as SMEs often have fewer resources than larger companies, which can make it difficult to implement and maintain ESG practices

Malaysia’s aim to achieve carbon neutrality by 2050 demonstrates its dedication to becoming a leading force in regional decarbonisation. The country’s growing focus on sustainability is fostering a culture of monitoring, measuring, and ultimately, taking responsibility. This can serve as a framework for ESG-minded firms to chart their own journeys. This will also bolster the country’s attractiveness as a destination for investment and business and attract quality Foreign Direct Investment (FDI) into the country. Furthermore, when foreign investors support projects that promote ESG, host countries can reap the benefits of industry-specific expertise, technology transfer, and job creation in sectors that contribute to environmental and social progress.

Phillip Capital Management Sdn Bhd (PCM)’s role in ESG

In line with the nation’s goal towards sustainability, PCM has integrated ESG factors that we attest as material and relevant for a company’s financial performance and long-term sustainability into our investment decision-making process. These include but not limited to ESG ratings by established index, environmental considerations (climate change, natural resources preservation, pollution & waste), social considerations (health & safety, community engagement, employee relations) and governance considerations (board independence, transparency & disclosure, shareholder rights).

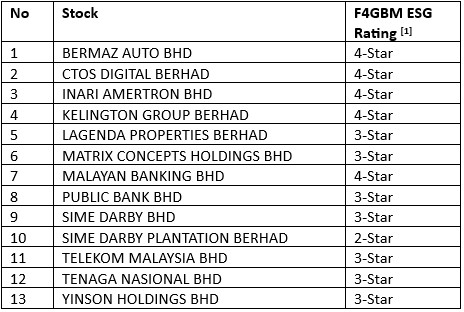

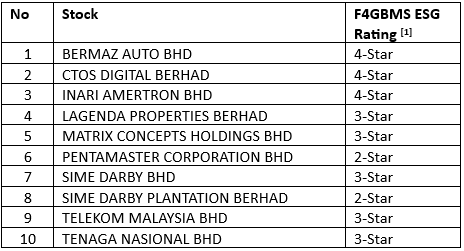

Separately, PCM offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Here is the list of stocks in our ESG mandates.

Table 1: ESG Mandates – Stock List 2024

Conventional ESG Portfolio

Shariah ESG Portfolio

Source: PCM

We will consistently assess our holdings and adjust our portfolio as necessary to align with prevailing market conditions. Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Note:

[1] ESG Ratings of Public Listed Companies (PLCs) assessed by FTSE Russell in accordance with FTSE Russell ESG Ratings Methodology, December 2023 – link

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.