Global markets remained weak throughout September, with MSCI World declining -4.6% due to challenges in the US markets, including labour union strikes and government shutdown fears. In addition to that, the market’s expectations were dashed as the Fed’s hawkish stance raised concerns about prolonged high interest rates, hence prompting the spike in bond yield and dollar strength. Across the pond, MSCI Asia Pacific ex Japan lost -3.3% in September primarily due to negative sentiment in China. However, India’s positive economic outlook, anticipated as the world’s fastest-growing major economy, provided some support. The World Bank now expects developing East Asia and Pacific to grow 5% in 2023 (previous: 5.1%) and 4.5% in 2024 (previous: 4.8%).

The weakness persisted in October following the recent attack on Israel by the Palestinian militant group Hamas, prompting substantial reactions in global stock, bond, and commodity markets. Investors are turning to safe-haven assets like gold due to the heightened uncertainties. Markets see the recent surge in US yields may substitute for additional hike in rate. In the energy sector, there could be increased volatility if the conflict escalates to involve Iranian oil exports, which account for approximately 2 million barrels per day. This escalation might have a significant impact on oil prices, which in turn, contributes to higher inflation and adds complexity to the Fed’s hawkish stance. We continue to exercise caution on the market.

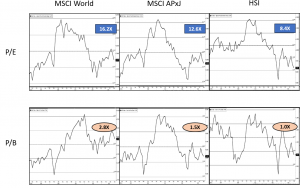

Consequently, global market valuations have declined from their peak levels. Presently, MSCI World and MSCI Asia Pacific ex Japan are trading at 16.2x and 12.6x respectively, both nearing one standard deviation below the mean. Among the markets we monitor, the Hong Kong market is the cheapest, trading at 8.4x and approaching nearly two standard deviations below the mean.

Exhibit 1: MSCI World, MSCI Asia Pacific ex Japan and Hang Seng Index valuation band

Source: Bloomberg, compiled by PCM, as of 30 September 2023

Exhibit 2: Market Valuations

| Indices | Forward P/E |

| HONG KONG (HSI) | 8.4x |

| KOREA (KOSPI) | 10.3x |

| CHINA (CSI300) | 10.8x |

| EUROPE (STOXX 600) | 11.9x |

| MAPXJ | 12.6x |

| MALAYSIA (FBMKLCI) | 13.2x |

| TAIWAN (TAIEX) | 15.3x |

| MSCI WORLD | 16.2x |

| US (S&P 500) | 17.9x |

| INDIA (NIFTY 50) | 18.2x |

| JAPAN (NIKKEI 225) | 18.5x |

Source: Bloomberg, compiled by PCM, as of 30 September 2023

We maintain the view that the China/Hong Kong market remains relevant and offers numerous opportunities. China’s August and September data signals economic stability, with increases in industrial production, retail sales, and lending activity. In addition, property sales volume in September declined 20% YoY but rebounded 10% MoM thanks to supportive policies launched in Jul-Aug (CRIC data). What more, China is reportedly contemplating a stimulus plan, issuing over CNY1 trillion in sovereign debt for infrastructure spending, potentially exceeding the 3% budget deficit limit set in March. Separately, we expect the monetary policies are likely to stay accommodative while more expansionary policies to be in place in order to bolster the Chinese economy.

Back home, Malaysia’s domestic equity market has exhibited improved resilience post-state election, with foreign investor net inflows starting in July. Prime Minister Anwar Ibrahim’s initiatives like NETR, NIMP2030, 12MP-MTR, and Johor-Singapore Special Economic Zone are anticipated to enhance the country’s long term fiscal stability and competitiveness. Key event to watch is Budget 2024, which will be tabled on October 13. Budget 2024 marks the “first full budget” under PM Anwar Ibrahim’s leadership. We expect Budget 2024 to maintain a mildly expansionary stance despite narrowing its deficit through a combination of revenue broadening and subsidy rationalisation measures. This will put the country on track to achieve the deficit target of 3.5% of GDP by 2025 as stipulated in the 12th Malaysia Plan midterm review.

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

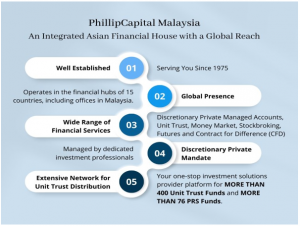

Phillip Capital Malaysia offers a comprehensive suite of financial services including managed accounts and unit trusts, that may suit your investment preferences and financial goals. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.