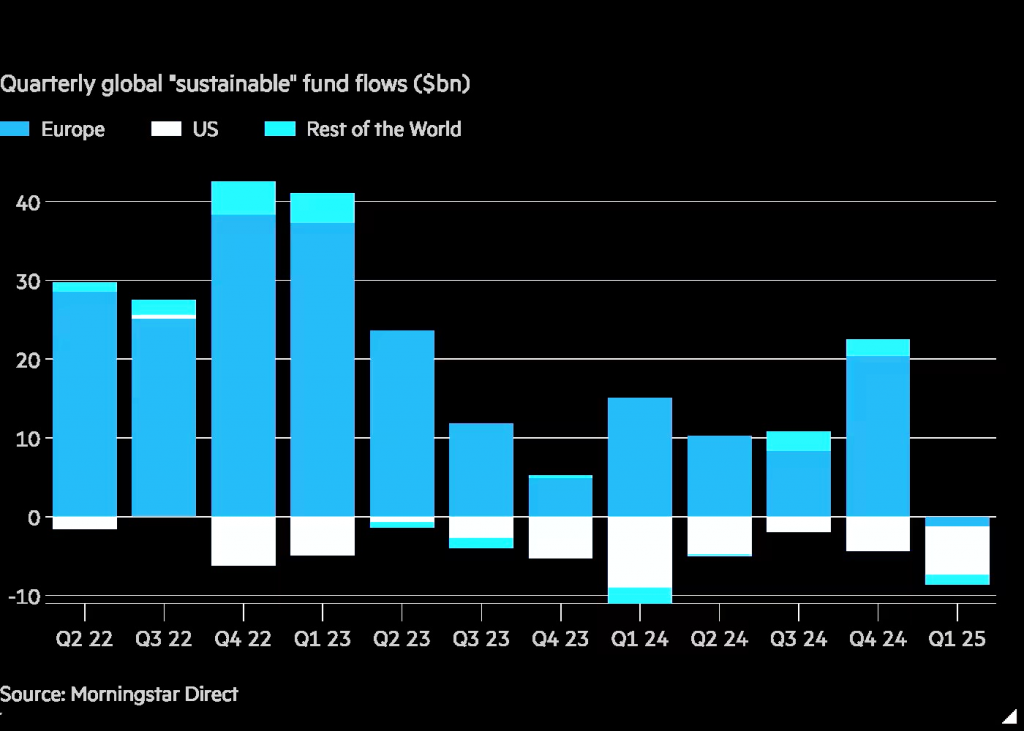

In the first quarter of 2025, investors withdrew a record $8.6 billion from sustainable funds, signaling that the backlash against ESG (environmental, social, and governance) investing — once primarily a U.S. phenomenon — is now spreading globally. For the first time since at least 2018, European investors became net sellers, pulling out $1.2 billion, while Asian investors also cut exposure. A further 94 European funds were liquidated or merged, while US fund closures hit a record quarterly level of 20.

The pushback is fueled by criticism that ESG investing prioritizes social and political agendas over financial returns, a narrative gaining traction particularly under the Trump administration. Additionally, in Europe, the traditional exclusion of defense companies from ESG portfolios is being reconsidered amid regional rearmament efforts. The changing regulatory landscape, including tougher EU rules against greenwashing, has led to widespread fund name changes, liquidations, and mergers. Experts warn that redefining sectors like defense as ESG-compliant could confuse and alienate traditional ESG investors.

Figure 1: ESG Fund Flows

Source: Financial Times, 25 April 2025

According to the list of SRI (Sustainable and Responsible Investment) funds published on the Securities Commission Malaysia’s website, there were only 4 retail SRI funds in 2024 compared to 11 in 2023, while the number of wholesale SRI funds rose to 8 in 2024 from just 1 in 2023, keeping the overall total roughly unchanged. This marks a slowdown from 2022, when there were 7 retail SRI funds and 13 wholesale SRI funds. We believe the SRI fund market in Malaysia is still at a nascent stage and has strong potential for future growth.

We reaffirm that Malaysia should remain steadfast in leveraging its inherent strengths in ESG development. While the Trump’s policies and regulatory rollbacks may eventually influence global investment strategies, corporate governance, and business practices in the realm of ESG, we believe the direct impact on Malaysia will not be immediate. Malaysia should continue prioritizing homegrown policies and initiatives such as the development of green sukuk and the execution of the National Energy Transition Roadmap (NETR). By doing so, Malaysia can drive sustainable economic growth, attract high-quality investments, and strengthen its leadership in green finance. Staying committed to our local ESG agenda will not only foster resilience but also position Malaysia as a forward-looking, environmentally responsible economy on the global stage.

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

In line with the nation’s goal towards sustainability, Phillip Capital Management has integrated ESG factors that we attest as material and relevant for a company’s financial performance and long-term sustainability into our investment decision-making process. These include but not limited to ESG ratings by established index, environmental considerations (climate change, natural resources preservation, pollution & waste), social considerations (health & safety, community engagement, employee relations) and governance considerations (board independence, transparency & disclosure, shareholder rights).

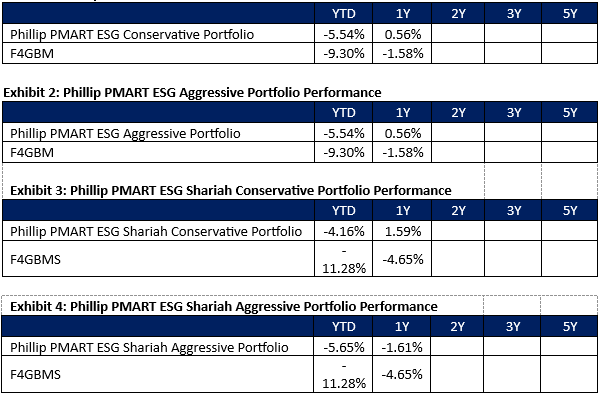

Separately, PCM offers PMART and PMA ESG, a discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Exhibits 1-4 show the performance for PMART ESG Conventional and Shariah.

Source: PCM, 31 March 2025, link

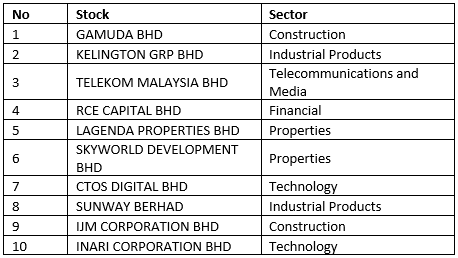

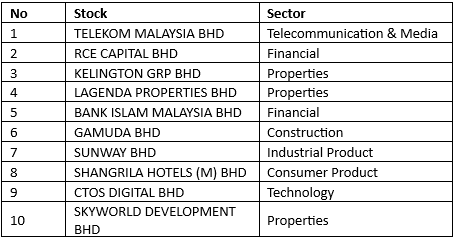

Here are the top 10 holdings in our Conventional and Shariah mandates, respectively. Please note that this list is provided for informational purposes only and does not constitute a recommendation.

Conventional

Shariah

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.