Following the reelection of President Donald Trump, major financial institutions in the U.S. have started to reassess and alter their Diversity, Equity, and Inclusion (DEI) policies. JPMorgan Chase, the largest U.S. bank, recently renamed its DEI program to “Diversity, Opportunity & Inclusion” (DOI), explaining that “equity” meant equal opportunity, not equal outcomes. This shift reflects the bank’s efforts to adapt to regulatory changes and market pressures. Other major financial institutions, like Citigroup and Goldman Sachs, have also scaled back or changed their DEI practices, with Citigroup no longer requiring diverse candidate slates for interviews and Goldman Sachs abandoning policies aimed at increasing board diversity. These changes follow the Trump administration’s executive orders to limit DEI initiatives across government and corporations, which has led to widespread adjustments in corporate diversity programs.

The shift in U.S. financial institutions’ DEI policies could impact Malaysia through changes in investment strategies, corporate governance, and local business practices. Multinational companies operating in Malaysia may adjust their DEI initiatives, influencing global partnerships, corporate standards, and governance, potentially affecting local firms’ strategies and international relations. We, however, believe that the direct impact on Malaysia might not be immediate. Echoing our previous article titled “Trump’s Day 1 Energy Agenda: A Shift Toward Fossil Fuels”, Malaysia should maintain its focus on local policies and initiatives like green sukuk and prioritize efforts related to the National Energy Transition Roadmap (NETR). These initiatives can drive sustainable growth, attract investments, and enhance the country’s position as a leader in green finance, while fostering economic resilience and environmental responsibility.

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

In line with the nation’s goal towards sustainability, Phillip Capital Management has integrated ESG factors that we attest as material and relevant for a company’s financial performance and long-term sustainability into our investment decision-making process. These include but not limited to ESG ratings by established index, environmental considerations (climate change, natural resources preservation, pollution & waste), social considerations (health & safety, community engagement, employee relations) and governance considerations (board independence, transparency & disclosure, shareholder rights).

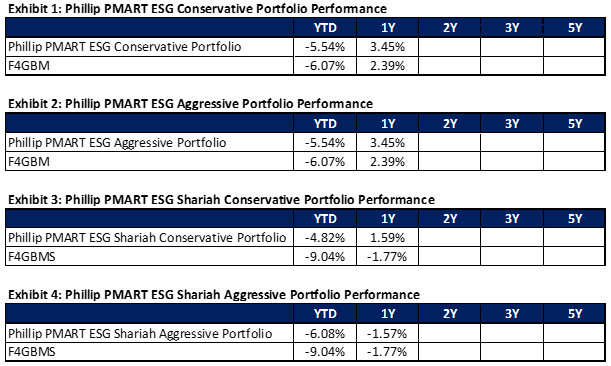

Separately, PCM offers PMART and PMA ESG, a discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Exhibits 1-4 show the performance for PMART ESG Conventional and Shariah.

Source: PCM, 28 Feb 2025, link

Comments on Performance:

The Malaysian market remained weak throughout the month, with mid and small-cap stocks lagging behind large-cap stocks. The results season was mixed, with sectors like oil & gas, technology, healthcare, rubber products, consumer, and auto underperforming, while plantations, transport, property, and basic materials exceeded expectations. Positive earnings revisions were seen in REITs, plantation, banking, and property. Valuation remains attractive with the KLCI trading at 13.8x P/E, 1 standard deviation below its 10-year mean. FBM Emas which comprises the big, medium and small cap companies in Malaysia now trades at 13.4x P/E, 1.3 standard deviation below its 10-year mean. We remain vigilant in our stock and sector selection against increasing macro risks from trade tensions and geopolitical uncertainties.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.