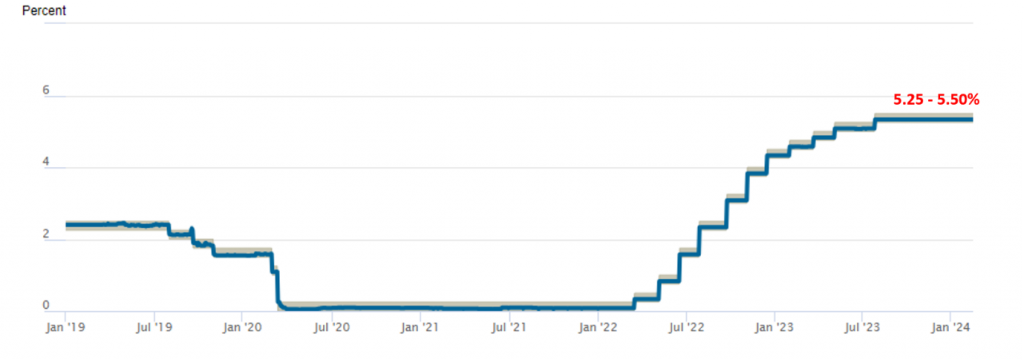

The Federal Open Market Committee (FOMC) meeting in January 2024 concluded with the decision to maintain the Fed funds interest rate within the range of 5.25% to 5.50%, as widely anticipated by the market consensus. Notably, the Fed funds rate has been held steadily for about eight months since the last rate hike of 25 basis point back in July 2023 (see Exhibit 1).

Exhibit 1. Fed funds rate since 2019

Source. The Federal Reserve (Fed)

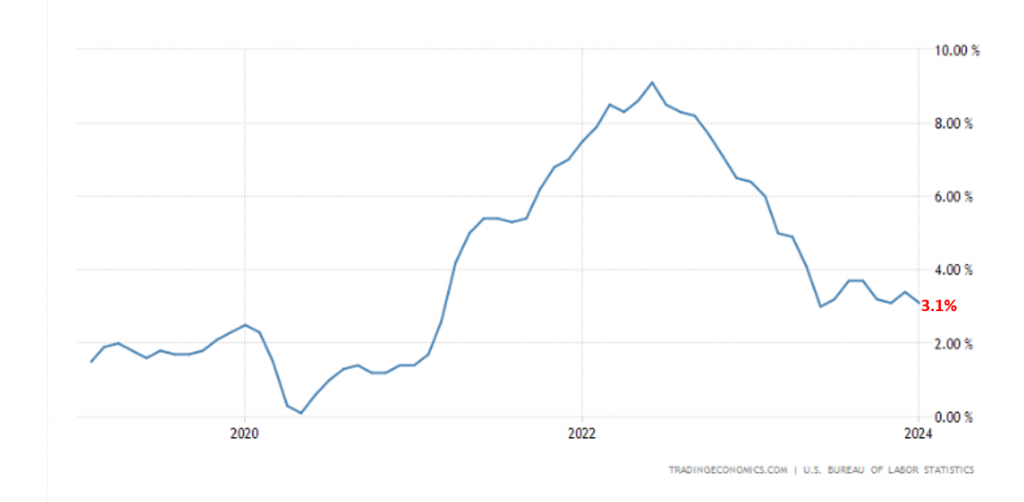

Since March 2022, the FOMC began a 25-basis point interest rate hike aiming to bring inflation back to its 2% target. Following several rate hikes in the past two years to combat inflation, a sustained decrease in inflation rates has prompted the Fed to ease its stance, temporarily pausing rate hikes (see Exhibit 2).

Exhibit 2. US Headline CPI

Source. US. Bureau of Labor Statistics

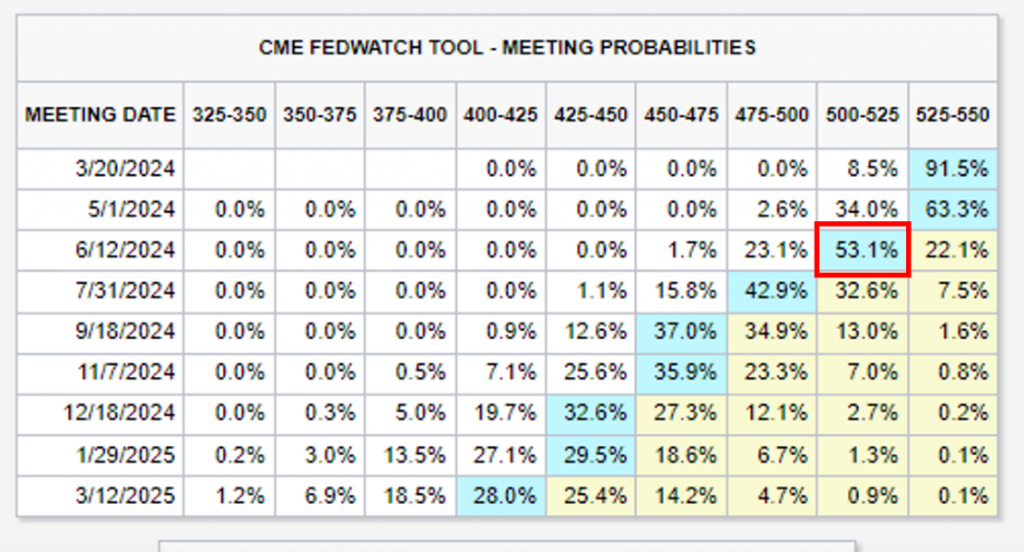

The market had previously expected the first rate cut to occur during the March 2024 FOMC meeting. However, due to the recent hawkish tone in the Fed’s statement (coupled with still-sticky January inflation figures), expectations are now shifting, with the market expecting the first rate cut to begin as early as the June FOMC meeting (see Exhibit 3), with a 53.1% probability as of 21 February 2024.

Exhibit 3. Market consensus of Fed funds rate

Source. CME FedWatch tool, as of 21 Feb 2024

What are the potential implications for the Malaysian market following a U.S. rate cut?

1. Potential appreciation of MYR against USD

A rate cut by the Fed usually results in the depreciation of the US dollar as lower interest rates reduce the yield on investments in US dollars, making them less attractive to foreign investors. The movement of capital towards higher-yielding assets in alternative currencies would favour emerging market currencies, including the Malaysian Ringgit. Appreciation of the Malaysian Ringgit in relative to the US dollar can result in cheaper imports, which is advantageous for sectors heavily reliant on imported goods, i.e. Construction sector that rely heavily on import of construction materials (Iron and Steel), Utilities sector (i.e. Tenaga) whereby a significant portion of its operational expenses comes from importing coal, which is priced in USD. Separately, the Automotive and Consumer sectors could also see benefits since their raw materials are sourced through imports.

2. Increase of Foreign Direct Investment (FDI) flow into Malaysia

Investors often seek the best returns for their capital. With lower interest rates in the US, capital tends to flow towards economies that provide better yield in investment, for example, Malaysia, with its dynamic economy and strategic position in the Southeast Asia, can become a more attractive destination for FDI yield.

In July 2023, PM Datuk Seri Anwar Ibrahim unveiled the Madani Economy framework, aiming to encourage both Domestic Direct Investment (DDI) and Foreign Direct Investment (FDI) and eventually develop Malaysia into a leading economy in Asia.

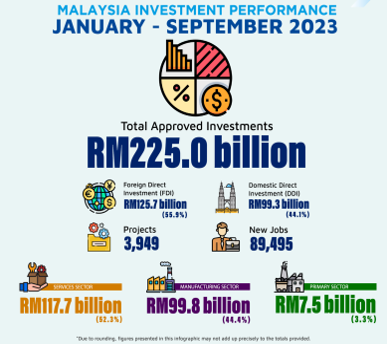

According to the statistic released by Malaysian Investment Development Authority (MIDA), as of the first three quarters of 2023, the total approved investments reached RM225 billion, with DDI contributing 44% and FDI contributing 56%. This figure not only surpasses the full-year target of RM220 billion set for 2023 but also marks a 6.6% rise compared to the RM211 billion recorded in the same period of 2022 (see Exhibit 4). In addition to the approved investment figures, several investments have been announced for the period from 2021 to 2024, which are anticipated to materialise in the upcoming period (see Exhibit 5).

We are positive that the increased FDI would benefit sectors like Technology (specifically Semiconductor and Data Centre), as Malaysia’s abundant natural resources and high skilled workforce would stand out as its competitive advantage to attract FDI.

Exhibit 4. Malaysia Investment Performance Jan-Sep 2023

Source. MIDA

Exhibit 5. FDI announced for the period 2021 – 2024

Source: Various, compiled by PCM

3. Potential surge of bond price in Malaysia

A Federal Reserve rate cut can significantly influence Malaysia’s bond market by making Malaysian bonds more attractive to international investors seeking higher yields than those available in the United States, due to lower yields on US Treasury securities. This increased demand can drive up the prices of Malaysian bonds.

Additionally, a Fed rate cut often leads to a depreciation of the US dollar, enhancing the appeal of Ringgit-denominated bonds for foreign investors as the Malaysian Ringgit strengthens. The prospect of lower future yields, in response to potential rate cuts by Bank Negara Malaysia mirroring the Fed’s policy shift, could further elevate bond prices. Moreover, global economic uncertainties that prompt Fed rate cuts can shift investor preference towards safer assets like government bonds, including those from Malaysia, affecting both government and corporate sectors by potentially lowering borrowing costs and stimulating economic activity.

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

PMART/PMA Dividend Enhanced

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors.

Click here to learn more.

PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.