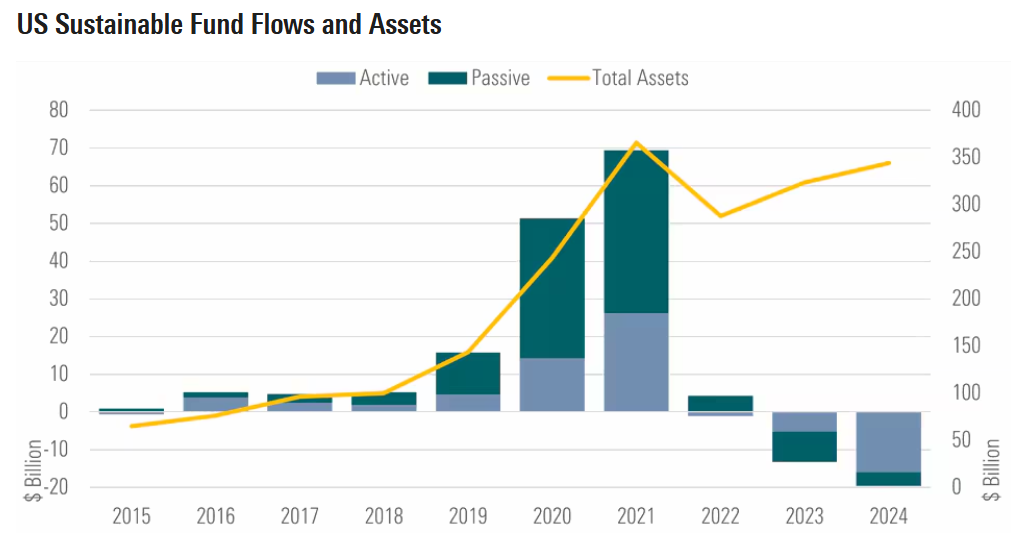

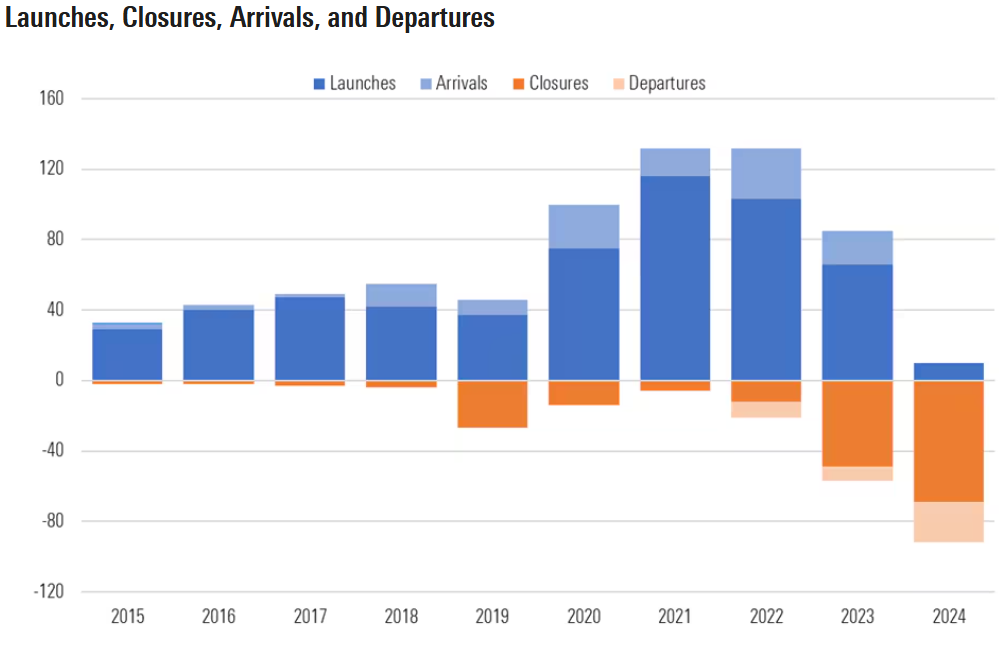

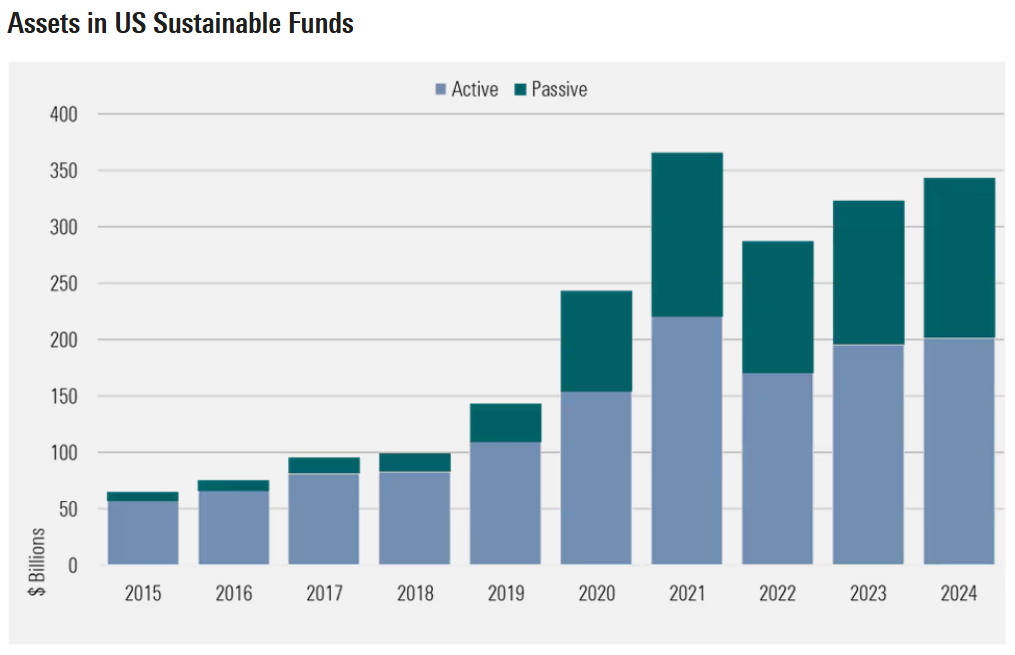

Sustainable investing-focused mutual funds and ETFs faced major challenges in 2024, with record outflows of $19.6 billion in the U.S., a sharp decline from 2023’s $13.3 billion (Figure 1). The downturn was driven by underperformance, high interest rates, political backlash, and greenwashing. The number of sustainable fund closures surged in the U.S., with 71 funds merged or liquidated, and 24 dropping their ESG mandates, both record highs (Figure 2). At the end of 2024, there were 587 sustainable open-end funds and ETFs, down 9% from 2023. Despite these struggles, AUM in the U.S. rose 6.3% to $344 billion due to broader market gains (Figure 3).

Figure 1: US Sustainable Fund Flows and Assets

Source: Morningstar Sustainalytics, data as of 16 Jan 2025

Figure 2: Number of US Sustainable Funds

Source: Morningstar Sustainalytics, data as of 16 Jan 2025

Figure 3: Asset Under Management in US Sustainable Funds

Source: Morningstar Sustainalytics, data as of 16 Jan 2025

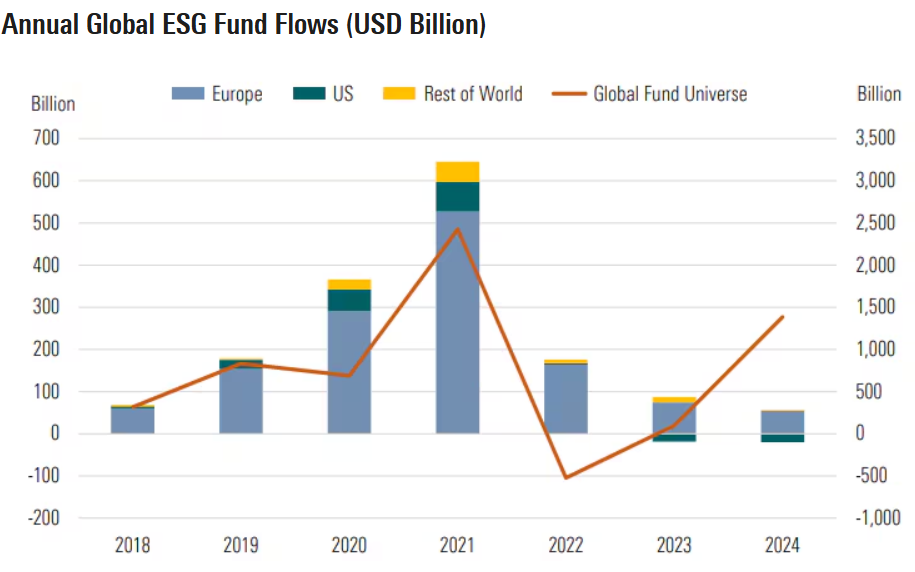

But, it isn’t all bad news. Europe, which accounts for 84% of the world’s ESG fund assets, still booked $52.4 billion in inflows for 2024, a decline from $77.7 billion in 2023 (Figure 4). Morningstar’s analysis revealed that in 2024, European Article 9 funds experienced €7.3 billion in redemptions, marking the fifth consecutive quarter of outflows, with equity funds suffering the largest withdrawals. In contrast, Article 8 funds saw €52 billion in inflows, driven by demand for fixed-income assets, and Article 6 funds attracted €85.4 billion in inflows.

Figure 4: Annual Global ESG Fund Flows

Source: Morningstar Direct, data as of 31 December 2024

Europe’s ESG Commitment vs. U.S. Backlash

The heyday of sustainable investing is facing challenges on both sides of the Atlantic. In Europe, sustainable investing is increasingly seen as a core component of fiduciary duty, with strong regulatory frameworks and a rising demand for ESG-focused funds. However, in the U.S., the political landscape has shifted, particularly under current President Donald Trump, who argued that prioritizing ESG factors could undermine profitability. This has sparked a backlash, with growing concerns that sustainable investing goes against fiduciary duty by not maximizing shareholder value. As a result, the two regions now have contrasting approaches to sustainable investment, influencing global trends.

Malaysia’s Growing Presence in Sustainable and Responsible Investment

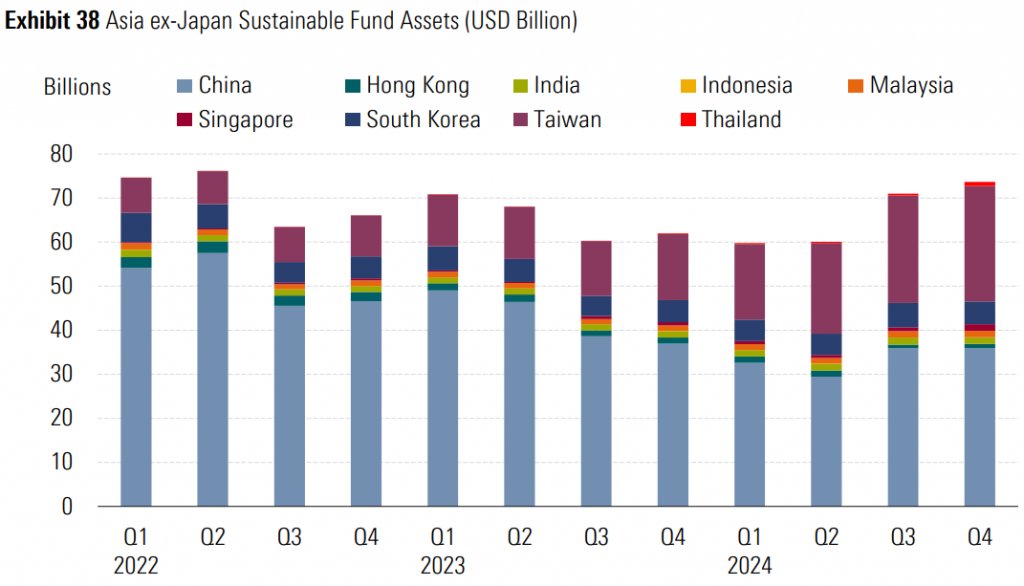

Malaysia is still in the early stages. Data from the Securities Commission Malaysia shows that as of 30 November 2024, there were 46 Unit Trust Funds and 32 Wholesale Funds classified under Sustainable and Responsible Investment (SRI), totaling 78 funds. In terms of AUM, Malaysia holds a small share within Asia ex-Japan (Figure 5).

Figure 5: Asia ex-Japan Sustainable Fund Assets

Source: Morningstar Direct, data as of 31 December 2024

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

In line with the nation’s goal towards sustainability, Phillip Capital Management has integrated ESG factors that we attest as material and relevant for a company’s financial performance and long-term sustainability into our investment decision-making process. These include but not limited to ESG ratings by established index, environmental considerations (climate change, natural resources preservation, pollution & waste), social considerations (health & safety, community engagement, employee relations) and governance considerations (board independence, transparency & disclosure, shareholder rights).

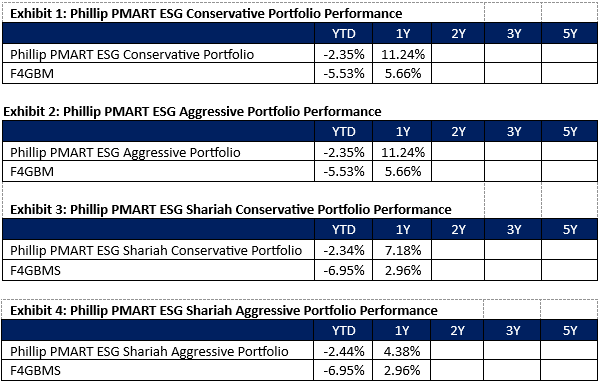

Separately, PCM offers PMART and PMA ESG, a discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Exhibits 1-4 show the performance for PMART ESG Conventional and Shariah.

Exhibit 2: Phillip PMART ESG Aggressive Portfolio Performance

Source: PCM, 31 Jan 2024, link

Comments on Performance:

The Malaysian market saw weak performance in January, primarily due to profit-taking and foreign selling, particularly in AI/DC-related stocks, after news of Deepseek’s Large Language Model (LLM) performance dampened sentiment on capex investment. As a result, our holdings in Technology, Property, Industrial, and Construction were impacted. However, our decline was smaller than the benchmark. We believe that Moody’s reaffirmation of Malaysia’s sovereign credit rating at ‘A3’ – an upper-medium grade with low credit risk – highlights the country’s continued appeal as an investment destination. On a separate note, Malaysia market has never been this attractive in quite a while, with foreign shareholding hitting a record low of 19.4% in January.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.