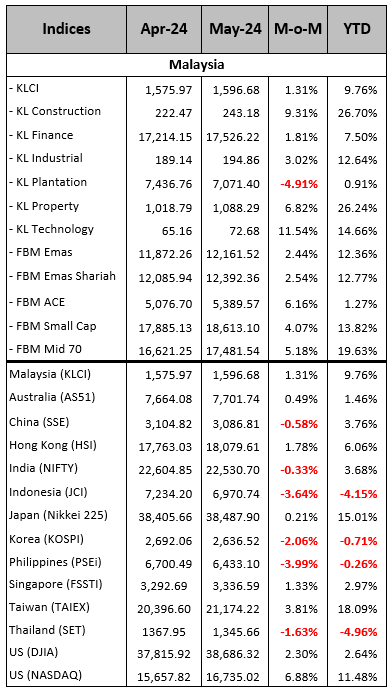

The Malaysian market has performed exceptionally well this year, with the KLCI recording nearly a 10% increase as of May 31, 2024. All sectors have posted positive returns so far in 2024, with the Construction and Property sectors outperforming significantly, up by more than 20% year-to-date.

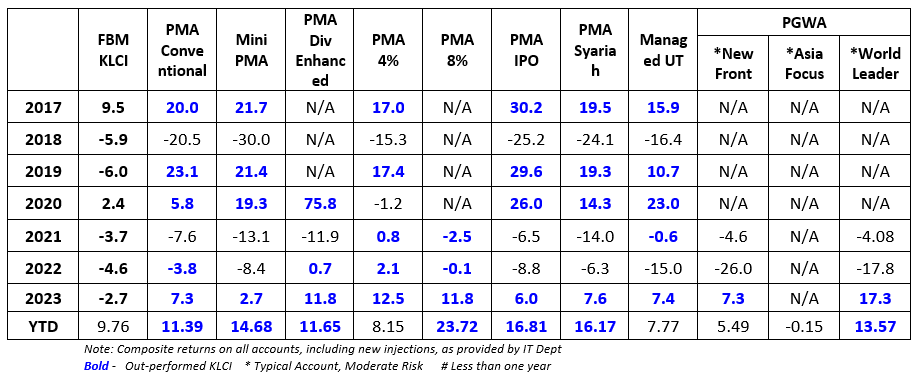

Table 1: Summary of Market Performance as of 31 May 2024

Source: Bloomberg, 31 May 2024, compiled by PCM

Since last year, we have been optimistic towards the Malaysian market due to the country benefitting from trade diversion, a boost from Chinese tourism, and strong economic fundamentals. Despite global economic weaknesses, Malaysia’s attractive valuations and robust growth, especially in the Tech & E&E sectors, support this positive outlook. Refer our article ‘Malaysia – Look for Silver Linings’.

The conclusion of the state elections has further improved market conditions, while we applauded Prime Minister Anwar Ibrahim’s and the unity government’s effort in bolstering the nation’s long-term fiscal stability and strengthening its competitiveness, through a series of masterplans which include but not limited to National Energy Transition Roadmap (NETR) (link to our article), New Industrial Master Plan 2030 (NIMP2030) (link to our article), 12th Malaysia Plan Mid-Term Review (12MP-MTR), the special financial zone for Forest City, and Budget 2024 (link to our article).

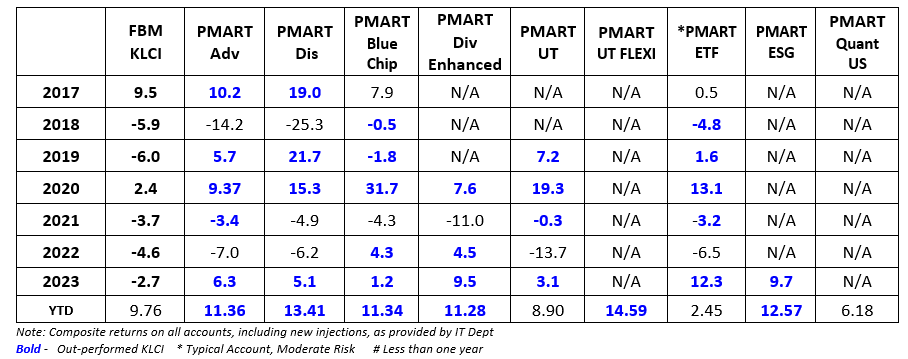

We remain bullish on Malaysia, maintaining an overweight position in the market ever since the publication of our inaugural ‘Monthly Investment Insights and Strategy Series by PCM’ beginning from November 2023, and the view has not changed till then. As a result, we are proud that our Managed Account achieved remarkable performance in 2023, which has continued into 2024. This is driven by our commitment to effective bottom-up stock selection and prudent management practices, enabling us to navigate the market adeptly. Please find Table 2 below for our performance as of 31 May 2024.

Table 2: PCM Private Managed Accounts Historical Performance

A: Phillip Managed Account for Retirement (PMART)

B: Phillip Managed Account (PMA) & Phillip Global Wrap Account (PGWA)

Source: PCM, 31 May 2024

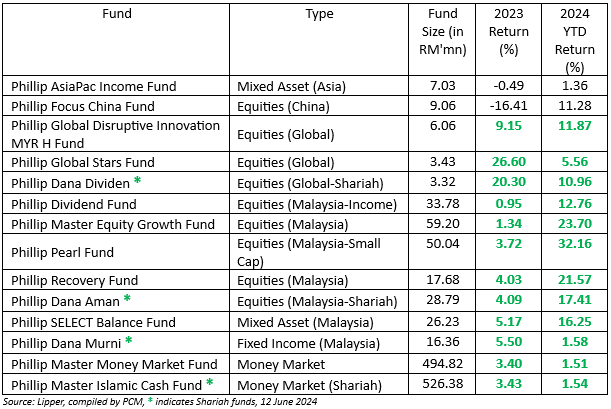

Separately, our in-house managed unit trust funds have also shown remarkable performance this year.

Table 3: PMB Unit Trust Funds 2023 & 2024 YTD Performance, as of 12 June 2024

After a strong YTD performance, we remain overweight in Malaysia premised on the reasons below:-

- With strong earnings reported, we anticipate further positive earnings upgrades ahead

The overall first quarter 2024 result met our expectations, several sectors generated good growth in 1Q24. These include Auto, Construction, Conglomerates, Consumer Staples, REITs, Healthcare, Real Estate, Telecoms, Transport, Oil Services, and Utilities. In addition, Industrial Goods, Technology and Consumer Discretionary are turning around from relatively low bases. Plantations and Petrochemicals were below expectation, but we expect these sectors to recover off their low bases. Overall, the robust earnings reported instill confidence in achieving strong earnings growth in 2024F.

- Better policy clarity and implementation should drive Malaysia equities higher.

We see an improved policy landscape post state election. 2024 and 2025 mark the execution period for the masterplans committed by the unity government in 2023. We observe accelerated implementation of Budget 2024, NETR, NIMP, and Special Economic Zone, primarily benefiting local players in construction, property, utilities, and renewable energy sectors. The Cabinet has also recently agreed to implement targeted subsidies, which will begin with diesel, saving RM4bn annually. This signals the MADANI government’s commitment to economic reforms which are generally positively viewed by the stock market.

- Domestic liquidity has strengthened due to increased buying by local institutions.

EPF’s domestic exposure now exceeds 70% of its portfolio, as CEO Ahmad Zulqarnain Onn indicated at a panel session during day two of Bank Negara Malaysia’s (BNM) Sasana Symposium 2024, rising from about 64:36 (domestic-foreign) at the end of 2022. CEO Ahmad Zulqarnain Onn also mentioned, “In fact, we have no problem meeting 80:20, if you ask me”, indicating potentially more buying activities to stimulate the Malaysian market. Finally, EPF also highlights untapped Malaysian investment opportunities in sectors like data centres and industrial logistics, noting their strong growth potential. (Source: The Edge)

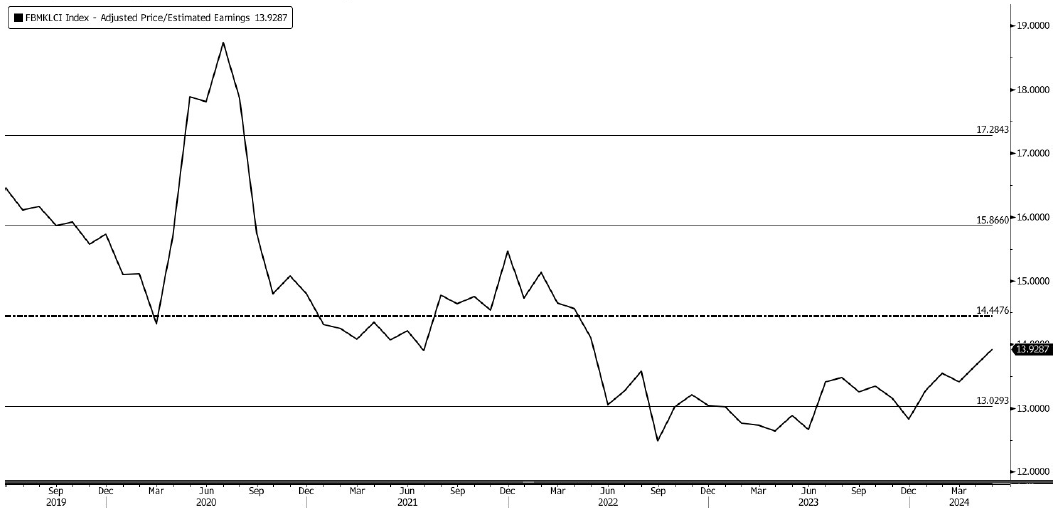

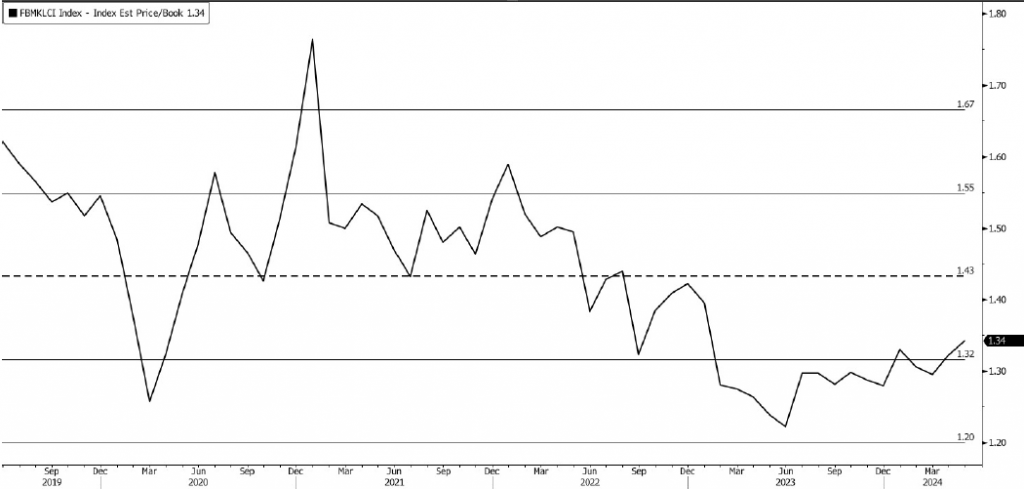

- Valuation remains cheap despite the recent run-up.

Currently, the KLCI is trading at a P/E ratio of 13.9x, which is still below its 5-year average of 14.5x. Similarly, the index shows a depressed price-to-book ratio of 1.34x compared to its 5-year mean of 1.43x.

KLCI P/E Chart

Source: Bloomberg, PCM, 31 May 2024

KLCI P/B Chart

Source: Bloomberg, PCM, 31 May 2024

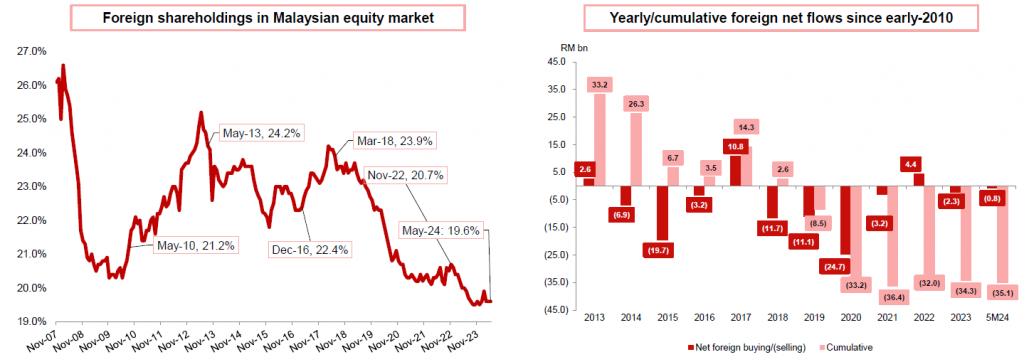

- The resurgence of foreign buying could provide additional momentum to the market.

Foreign investors turned net buyers in May 2024, posting a net buy value of RM1.5bn. This led the cumulative net foreign outflow since 2010 to decline to RM35.1bn. However, foreign shareholding in the Malaysian equity market (based on market capitalization) stayed at 19.6% despite the net inflow. We expect foreign buying to continue should we continue to see improved earnings delivery and better policy clarity. Additionally, the undervalued ringgit presents another reason for foreign investors to consider Malaysia as an investment destination, offering potential gains (i.e. carry) if the ringgit appreciates.

Source: CIMB

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.