In 2023, Malaysia experienced significant developments in the realm of ESG (environmental, social, and governance). Starting with the launch of Bursa Malaysia’s Bursa Carbon Exchange (BCX) in March and the announcement of National Energy Transition Roadmap (NETR) in July, the momentum continued with the ESG-focused Budget 2024 unveiled in October. Later that month, the Energy Efficiency and Conservation Bill was passed, underscoring the commitment to sustainable practices. A noteworthy milestone came in December 2023 when Malaysia, during COP28, pledged to achieve a 45% reduction in carbon emissions by 2030 compared to 2005 levels, reinforcing the country’s dedication to addressing climate change.

We have furnished several ESG write-ups over the past twelve months, as outlined below, and we greatly appreciate your readership.

- Driving value through ESG Investing

- How will ESG and Energy Transition evolve on the path towards Net Zero?

- ESG and Corporate Governance: Importance and Progress in Malaysia

- Malaysia’s Progress Towards Carbon Neutrality

- ESG Investing in the Era of Chaos

- Embracing Social Responsibility for Sustainable Growth

- When EV meets ESG

- The Influence of ESG Factors on Consumer Behaviour and Brand Perception

- The Rising EV Trend in Malaysia

- NETR Launch – Steps towards Sustainable Green Economy

- ESG: Catalyst for Enhanced Valuations and Profitability

- Strategic Positioning for ESG-Conscious Investors

- NETR Launch – Steps towards Sustainable Green Economy (Part 2)

- Sustainable Funds Regain Momentum in 2023

- ESG efforts in Budget 2024

- Malaysia’s Flood Mitigation Revolution

- Malaysia’s Pioneering Role in ESG Reporting for SMEs

- Malaysia’s Progress in Green Sukuk

- ESG gaining momentum in Malaysia

Looking ahead, we believe listed companies with good ESG practices will continue to benefit from the rising sustainability trend. Furthermore, we have pinpointed selected names within key sectors—Construction, Renewables, Utilities, and Property—that stand to benefit from the Net-Zero Transition Roadmap (NETR) and the policies outlined in Budget 2024. As companies enhance their ESG performance, we foresee a reduction in the risks associated with foreign labour dependency, a factor that historically affected industries such as Plantation, Construction, Gloves, and Electronic Manufacturing Services (EMS). With supply chains increasingly prioritising ESG criteria, ongoing government and corporate initiatives will help mitigate the risks of sanctions and reputational damage. This is crucial amid heightened ESG scrutiny, safeguarding trade opportunities.

Phillip Capital Management Sdn Bhd (PCM)’s role in ESG

In line with the nation’s goal towards sustainability, PCM has integrated ESG factors that we attest as material and relevant for a company’s financial performance and long-term sustainability into our investment decision-making process. These include but not limited to ESG ratings by established index, environmental considerations (climate change, natural resources preservation, pollution & waste), social considerations (health & safety, community engagement, employee relations) and governance considerations (board independence, transparency & disclosure, shareholder rights).

Separately, PCM offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies.

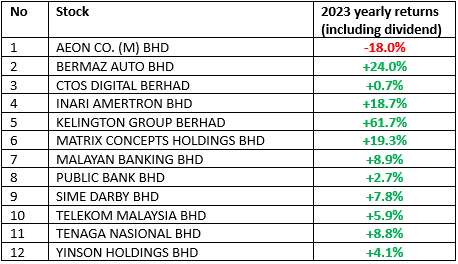

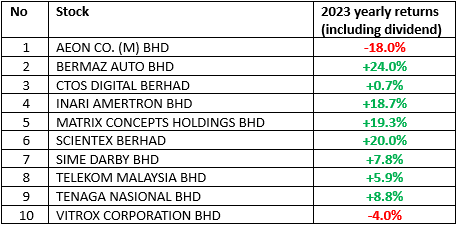

In our recent publication, we emphasised that despite the challenges in 2023, the majority of our Private Managed Accounts posted positive returns, surpassing the 2.7% decline observed in the KLCI. Specifically, our ESG portfolios demonstrated robust performance, achieving a significant positive return of +9.7%, outperforming the KLCI, which saw a decline of -2.7%, and surpassing the F4GBM Index, which recorded a modest increase of +0.7%. Here is the list of stocks in our ESG mandates for 2023.

Table 1: ESG mandates – stock list 2023

Conventional ESG Portfolio

Shariah ESG Portfolio

Source: PCM

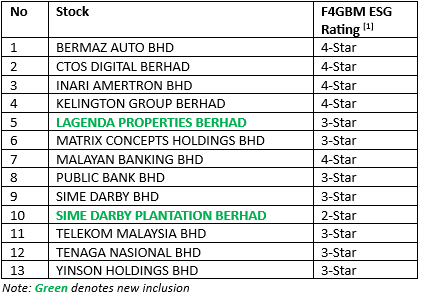

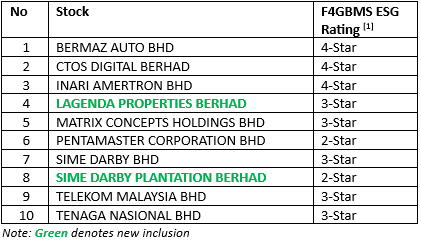

In 2024, we took out AEON CO. (M) BHD from our Conventional ESG Portfolio due to the company’s earnings recovery falling short of expectations and a downturn in consumer spending sentiment. We added LAGENDA PROPERTIES BERHAD and SIME DARBY PLANTATION BERHAD for thematic play. For Shariah ESG Portfolio, we took out AEON CO. (M) BHD for the aforementioned reason and SCIENTEX BERHAD for profit taking. Similar to Conventional Portfolio, we also added LAGENDA PROPERTIES BERHAD and SIME DARBY PLANTATION BERHAD for our Shariah Portfolio.

Table 2: ESG mandates – revised stock list 2024

Conventional ESG Portfolio

Note: Green denotes new inclusion

Shariah ESG Portfolio

Source: PCM

We will consistently assess our holdings and adjust our portfolio as necessary to align with prevailing market conditions. Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Note:

[1] ESG Ratings of Public Listed Companies (PLCs) assessed by FTSE Russell in accordance with FTSE Russell ESG Ratings Methodology, December 2023 – link

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.